Will Vwiax Continue to Fall in 2018

Investment Thesis

The Vanguard Wellesley Income Fund (MUTF:VWINX) has been an excellent long-term buy and hold investment for decades, but there's little doubt that the fund hasn't been well-positioned to take advantage of the current market environment.

On the fixed income side, the relatively small allocation to government bonds has performed well, but the corporate bond exposure has been plagued by credit quality worries. On the equity side, the fund's exposure to the tech & communication services sectors, the only two areas that have significantly outperformed the broader market, is less than half that of the S&P 500. Plus, with a yield of just 2%, it hasn't necessarily been capturing the attention of income seekers either.

But conditions are improving for a potential rotation out of growth & tech stocks and into the sectors that are favored by VWINX. This fund will likely always deserve consideration by long-term investors, but it could be setting up for a nice short-term bounce as well.

Background

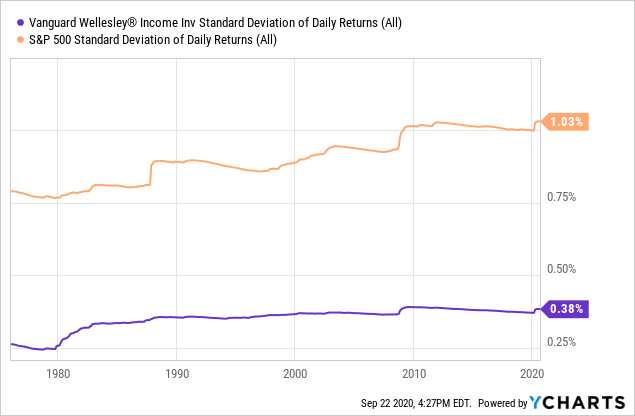

The Vanguard Wellesley Income Fund (VWINX) has long been one of my favorite mutual funds. Appropriate for investors of virtually any age or investment style, its 1/3 stock - 2/3 bond asset allocation plan has been providing investors superior risk-adjusted returns since its inception all the way back in 1970. Thanks to the greatest bond bull market ever, VWINX has generated a 10% average annual return since inception with less than 40% of the risk of the S&P 500 (SPY).

Data by YCharts

Data by YChartsVWINX is an actively-managed portfolio containing a combination of large-cap dividend-paying equities that are typically more value and defensive-oriented and a broad mix of government and investment-grade corporate bonds. The fund's primary goal is conservative total return via an all-in-one fully diversified vehicle.

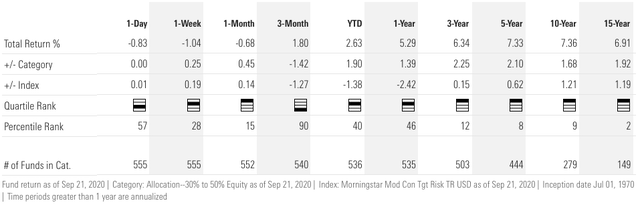

While the fund's long-term track record compares favorably with even all-stock portfolios, it fares especially well against its asset allocation counterparts.

Source: Morningstar

Source: Morningstar

Its long-term track record puts it in the elite tier of performers, but even its shorter-term 3-year performance places it nearly in the top decile. If you're looking for an all-weather portfolio in which you can "set it and forget it", you can't do much better than VWINX.

The caveat, of course, is that a fund that only has about 30-35% of assets invested in stocks may not be appropriate for long-term time horizons. Even a fund, such as VWINX, with a stellar record isn't likely to produce the type of returns one could achieve with an all-stock portfolio given enough time. It may ultimately be more appropriate for investors that are risk-averse or in or near retirement.

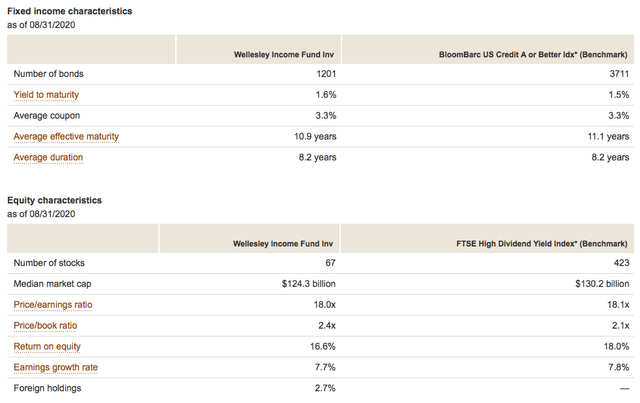

Current Portfolio

As it stands right now, the fund is invested in roughly the same style that it's always been. The fixed income side of the portfolio, as a whole, averages out to be an intermediate-term maturity investment-grade portfolio with a heavy lean towards corporate issues. The equity side features more mature, cash-rich companies that are undervalued and pay well-supported dividends.

Source: Vanguard

Source: Vanguard

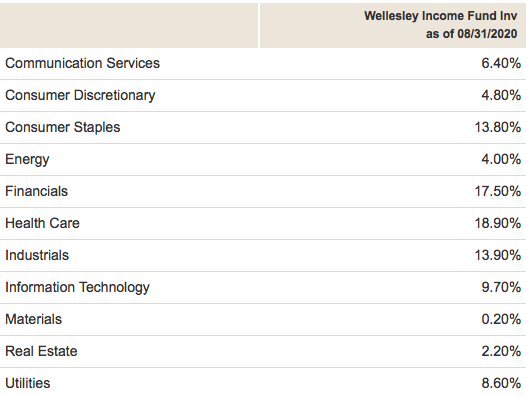

The equity side of the portfolio doesn't really resemble the S&P 500 at all. This is mainly due to its significant underweighting to the tech and communication services sectors. In the S&P 500, the two sectors account for about 40% of the index's weight, but in VWINX, they're only about 16%.

Source: Vanguard

Source: Vanguard

Instead, VWINX is overweight in the sectors you'd typically find in many value and dividend funds. In particular, this would include defensive areas of the market, such as utilities, healthcare and consumer staples, and cyclicals, such as financials and industrials. The defensive sectors offer more of the value and income components, while the cyclicals provide a bit of growth and higher yield potential.

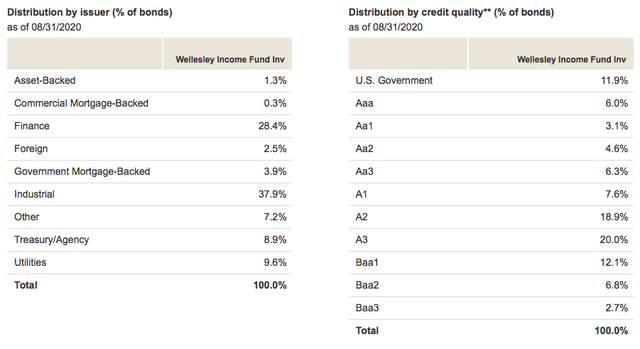

On the bond side, a modest allocation to government securities provides some stability, but this segment is far and away investment-grade corporate bonds.

Source: Vanguard

Source: Vanguard

Unlike many investment-grade corporate bond funds, VWINX focuses a little higher up on the credit quality ladder. For comparison, the iShares iBoxx $ Investment-Grade Corporate Bond ETF (LQD) has nearly half of its portfolio in BBB-rated bonds, the lowest tier still qualifying as investment-grade. VWINX has just 22% of assets in this group. The higher quality of the fixed income part of the portfolio is of particular advantage in the current economic climate, where credit risks have grown significantly.

Invested In Out Of Favor Sectors

As wonderfully as VWINX is constructed as a long-term investment, it's mostly been targeting all the wrong places over the past couple of years.

On the fixed income side, long-term Treasuries have nearly doubled the return of investment-grade corporates, which have in turn outperformed higher-grade corporates, such as those in the iShares AAA-A Rated Corporate Bond ETF (QLTA). Staying away from the junk bond market was wide in hindsight, but having just 12% of its fixed income portfolio in Treasuries turned out to be an unfortunate misstep.

On the equity side, I probably don't need to tell you what significantly underweighting tech has done to the portfolio. Financials and industrials have been significant laggards. The double-digit allocations to healthcare and consumer staples have also underperformed. Anything not fitting into that narrow growth/tech window has mostly fallen behind over the past few years.

Is That About To Change?

Tech has been the unquestioned driver of the stock market's returns over the past several years. People have been saying that value stocks are due for a comeback for years, but who knows when that's actually going to happen. Dividend stocks tend to lead and lag over multi-year cycles, so we could, with some degree of historical precedent, say that this group is due for a comeback.

I consider that the Fed has injected trillions of stimulus dollars into the economy along with the fact that the Fed Funds rate will stay at or near zero for at least the next few years. That alone will help support higher stock valuations and keep investors in a risk-on mood. That should present a positive backdrop for tech and growth stocks to continue leading the way.

I say "should" because I think macro conditions might be changing.

While everybody is talking about disinflationary pressures, I think that inflation is an under-appreciated risk. With all that cash, record low interest rates, a booming housing market and retail sales that are already back at pre-COVID levels, things are positioning for a spike in consumer prices. We're already seeing food prices move significantly higher over the past quarter. Could inflation in other goods and services be far behind? With the Fed willing to let inflation run hot until it achieves its new 2% averaging mandate, it's easy to envision a scenario where inflation starts getting ahead of itself before the Fed even reacts to do something about it.

Higher inflation likely leads to higher interest rates and a steeper yield curve? What investments tend to perform best in that type of environment? Financials and value stocks. Exactly the kinds of investments that VWINX is overweight in.

But VWINX is 2/3 fixed income. And we know well that fixed income will likely underperform in rising rate environments. The question is can VWINX still remain a top tier performer within its asset allocation category even in an environment not conducive to fixed income.

I think it can.

I'll point back to the overall higher credit quality of the bond portfolio. So many bond funds are reaching into the lowest possible tiers of fixed income that still qualify as investment-grade in order to maximize dividend income in this yield-starved market. With the global economic recovery slowing and an end date to the COVID pandemic still unknown, credit quality is still a major risk to even investment-grade corporate bond funds. The fact that VWINX is significantly overweighted in the AAA-rated to A-rated category, it should help limit share price losses without sacrificing a great deal of yield.

VWINX has already shown an ability to outperform its peer group in virtually any market environment. If the next year or so plays out the way I think it could, both the stock and bond portfolios within the fund look positioned to outperform their peer groups.

Conclusion

VWINX has been an outstanding investment for many years and will likely continue to be so well into the future. Its ability to outperform its peer group in both bull and bear markets speaks to the quality of the fund's management team, which still only charges 0.23% annually. Not bad for an actively-managed stock mutual fund, where expense ratios routinely run over 1%.

With any fund that sticks to its strategic guns, it will experience periods where its style is in favor and periods where it is not. The past couple of years fall into the "not in favor" category for VWINX, but I really think that could change over the next year. If the Fed bubble finally starts to leak and inflation becomes a problem, I think it's easy to see how both the stock and bond allocations within the fund could then be positioned to outperform.

Even if the higher inflation story doesn't play out soon, VWINX shareholders will likely still be pleased with the performance they get.

This article was written by

Editor of ETF Focus on TheStreet.com. A top 5 Seeking Alpha contributor in ETFs. Speaker at events, such as MoneyShow Orlando 2018. To receive notifications of new articles and blog posts as soon as they're published, click on the orange Follow button and become a real-time follower.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

farrellthatimbers.blogspot.com

Source: https://seekingalpha.com/article/4375905-vwinx-excellent-choice-fed-bubble-begins-to-leak

0 Response to "Will Vwiax Continue to Fall in 2018"

Postar um comentário